If we're going to add a ton more debt with an infrastructure bill, let's apply a lesson from history: pull people off the dole and put them to work on those infrastructure projects.....eliminate a majority of the welfare handouts and force able-bodied folks back to earning a living?

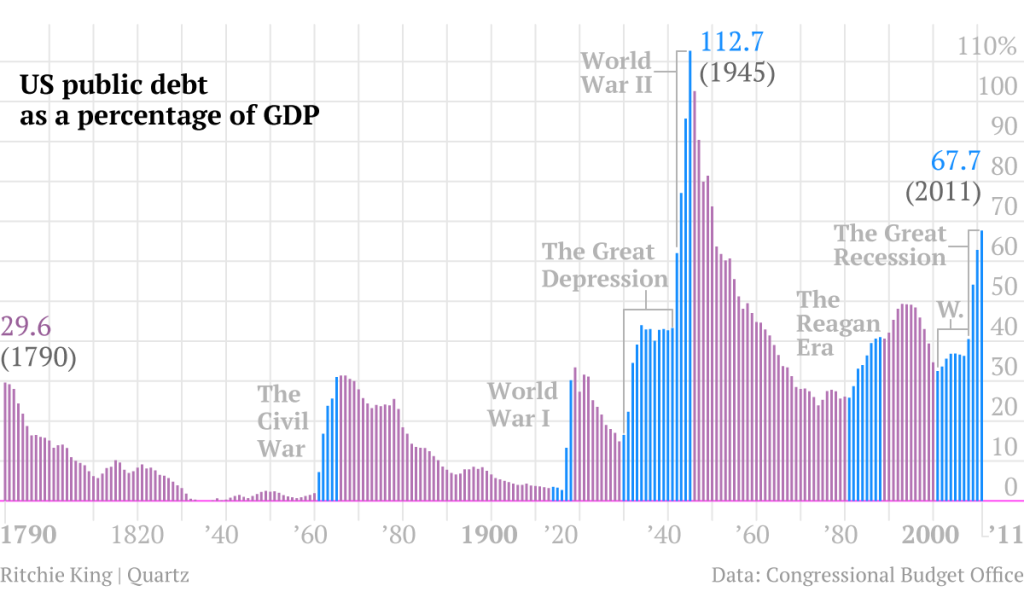

To start out and to be open, I was a Tea Party CUT DEBT advocate. We need SOME taxes to have a Nation, we just have to watch the level of debt/GDP ratio because it is the ratio of being able to pay for what we have or want. We as individuals of course do this with our personal budgets and unfortunately for the country THAT is what has gone out the window at the National level.

Our current problems actually go back to Reagan, because he started the speeches vilifying the "welfare dole," "cutting taxes to grow the economy" (Laffer curve now proven wrong four times!), and "debt is not a problem."

But as jlq1969 noted there will ALWAYS be some unemployed and the chart below confirms the thought. Note that this goes well before what some people now consider the welfare state that began the 1960s-70s. That's why Reagan stopped pushing that line about "welfare queens" once he got past the first year+ of being in office and getting called out on it repeatedly. Even worse, the huge borrowing and spending during his Administration pumped up the markets to the 1987 crash which then pushed up unemployment for Bush Sr and cost him re-election in 1992.

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65):fill(FFF)/cloudfront-us-east-1.images.arcpublishing.com/gmg/AXG4NV5JDJDERCVSOUB5HXPO7M.JPG)

So the charts and history show that we can set aside the idea that the problem is unemployment and number of people on the dole. Making matters worse, our actual low wage labor has ALWAYS come across the Southern border, like it or not. Having all those people willing to take jobs that 'Muricans would not take AND do them for cheap worked against inflation was good for the US. We all know how immigration has been going and now we are paying for it since the people left to do the hard physical work insist on real pay, pushing up prices. We also no longer have cheap labor in China or much of Asia to build our toys, because 50 years since they opened up they are largely a middle class society similar to the West. Even worse, since they are now consumers, we are competing for oil and resources, so more inflation. That also means the coming correction is going to be world level.

Clinton came in with the phrase "It's the economy." The difference from Reagan was that the Laffer curve (lower taxes to increase growth) idea was thrown out and by the time Clinton went out, there was actually a surplus for the first time in a long time. It happened because Clinton raised taxes to BOTH pay down the debt and create jobs and that is EXACTLY what Biden is trying to do.

But Biden has a big problem. Bush Jr borrowed like crazy to send us into wars that cost an average of one million dollars per soldier, so the debt took off worse than under Reagan. Unfortunately, Biden's Administration is contending with what was left of that, the Obama debt response to the Bush Jr collapse of 2007-2008 (which actually started to be paid down in 2015-2016), PLUS the unthinkable 2017 combination of both cutting taxes AND increasing spending. Although Trump pushed hard for it, the blame for that goes to McConnell and Ryan with Congress totally destroying the Tea Party concept by shirking their control of the purse.

So there's how we got here and the magnitude of the problem with charts to back it up.

To OldRider's question: Is inflation coming? No

It's already here and we have ourselves to blame.

To me - What this thread should be about are ideas for what WE as individuals should do to protect ourselves.

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65):fill(FFF)/cloudfront-us-east-1.images.arcpublishing.com/gmg/AXG4NV5JDJDERCVSOUB5HXPO7M.JPG)