For the forum - I wrote most of the following for family and it still has election type of talk in it, but the election debate is in another Lounge thread and the vote is behind us. I'm more focused on what we have and where we go with it. Now that he IS the Prez-Elect, maybe sharing some thoughts might do some good. Or maybe somebody else can add to it, or set me straight if this is all wrong. - CW

I like to study economics because it drives pretty much everything and because I make retirement money on through trading. When it came to Trump or Clinton they both were horrible candidates and I'm glad that we will no longer have the constant news about Clinton's baggage. But I also believe Trump will be worse for the country and stability in the world due to what he's shared about his financial plans. There is also opportunity in this.

This is a bit long because I had to work it out in my own head. If you want the bottom line, skip to the last paragraph, because my thoughts aren't as sexy as talking about whether or not to build a wall, who deleted what emails illegally (they BOTH did), ignores Benghazi on her part and Trump being part of New York organized crime (http://www.politico.com/magazine/story/2016/05/donald-trump-2016-mob-organized-crime-213910). Dang - It sure would have been better if they were both locked up.

BACKGROUND:

The US is already in hock for what we've spent since the Reagan era and then it got far worse when we started with the Middle East conflicts. A more important measurement is the ratio of debt to income, just like what you would need to show the bank if you wanted to take out a car loan or mortgage.

A better detailed post-Depression breakdown is at this link, where you can compare what Republicans and Democrats have done:

http://thumbnails-visually.netdna-ssl.com/united-states-debt-as-a-percentage-of-gdp-19402012_50290c7b3f0c4_w1500.jpg

So yes, we are in worse shape than leading into the Great Depression or Great Recession, but we are getting by.

???

Bringing it back to the two candidates, Clinton was billed as a "tax and spend Democrat." But while she DID want to increase spending (boo-hiss) at least her team identified how to increase taxes to pay for it. The economic plan Trump has been pushing for calls for even bigger increases in spending than she did, but with decreased taxes. The first chart showed that "trickle down" didn't work during Reagan, and it works even worse in a world where I can go online to move my money to a better return anywhere that I find. (You can find more charts showing that.) If you as an individual get a pay cut, the FIRST thing you know to do is to cut spending, but it's not what is happening at the national level.

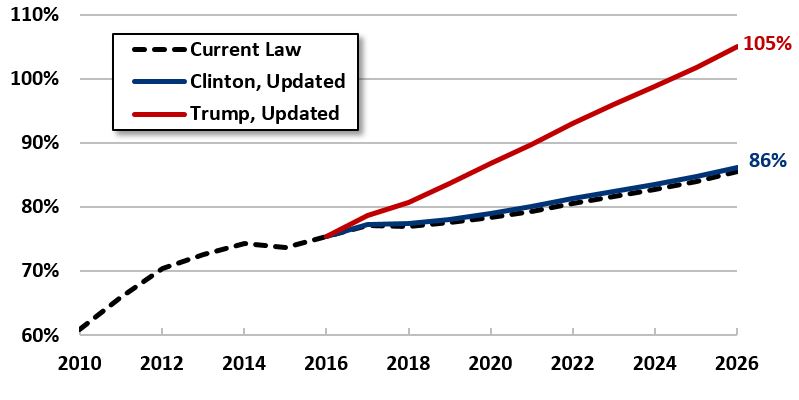

After 10 years, her plan would have cut the debt by roughly a trillion dollars and Trumps would increase it by more than 10 trillion. Easy numbers to remember. This compares what each was proposing:

(Source: http://crfb.org/blogs/what-we-know-about-president-elect-trumps-agenda)

Our two biggest national payments are Social Security and Medicare. After CRFB made the chart above, Clinton provided enough details regarding how she planned to shore up Social Security and it did have a tax increase, but at least it began right away (benefit of compounding interest) and she identified where she proposed taxing the wealthiest to get it. Trump STILL has not said what he wants to do about the shortfall in SS and since it will be later, it can't help but to hurt more. So borrowing was my first point and these payments are a related second part of debt.

Third, because of borrowing for his real estate (outside of the $650 million he owes the Chinese!!!), the Donald is closer to the New York bankers than Hillary was and his proposal to kill the Dodd-Frank Banking Act for them is going to remove the few protections created after the 2007 banking implosion which led to the crash. (https://en.wikipedia.org/wiki/Great_Recession) Did we learn nothing from that?

::010::

I'm a total rank amateur in putting this together, but it felt good when 400 leading economists in the world posted their letter and a lot of the same thoughts to reject the Trump plan. http://www.businessinsider.com/economists-denounce-trump-in-open-letter-2016-11 Interestingly, 350 economists had already denounced Clinton's proposals, but they did not endorse Trump's either, because his plan is not centered on restraint in spending and freedom to trade.

Using the above to go forward, my reading and own projection is that the borrowing and removal of protections ought to combine so that the next couple of years will be really prosperous while the Government is spending those loans and increasing OUR collective debt. That's money to be made! On the personal level, it's going to be REAL tempting to buy a vacation house and new cars and you KNOW how I like my toys.

But we all know that sooner or later every debt comes due and somebody has to pay up. Downturns are just part of life, but go back to the first chart and you can see that this ought to be much deeper and years longer than what we got in 2007-2009. It's basic economics 101, which us older folks have seen before in the US (1970s) and it is currently hitting countries like Venezuela hard. Storing up for lean times is repetitive history which we've all read about in the Bible (or Torah or Koran) and the good news is the next couple of years to store up.

The down side is that it is inevitable that adding debt to the charts above means that the dollar will sooner or later devalue badly as inflation REALLY takes off. Our first house had a 13.5% interest rate, which would more than double a current mortgage. What will that do to your budget if you have a variable loan? And it means that NOBODY is going to be able to buy your house, so have something you like long term and can afford. Us old folks will be retired and fixed retirement incomes will buy less and less, if locked into low rates. The debt still probably would have caught up to us if Clinton had been elected, but Trump's plan can not come out better.

BOTTOM LINE:

So my personal plan and suggestion is to make hay while the sun shines. Make as much as possible for the next couple of years and save up while we can, have no payments, and cut the mortgage as much and fast as possible. After the "high" of spending, in the latter portion of Trump's Presidency this should see inflation which will absolutely stop house construction, vehicle sales, vacationing, and other industries which so many of our jobs are dependent upon. If/when rates go up (not right now), gold and other things which rise with inflation will blow away a retirement annuity with a low rate. If my forecast and those of the economists are all wrong, we will still be in better shape financially and in a less stressful place emotionally. I'm sharing these thoughts is so that you might think about your own situation in light of a few more facts and not go on a borrowing spree.

Closing for the forum - The reason I've not said who I voted for is because it's in the past. We the public had a choice between really bad, worse, and a couple of candidates with no chance. At this point, please be thoughtful financially and no matter what party or candidate you supported, we need to collectively push our Congressmen as hard as possible for:

term limits so they represent the current views of their constituents,

a balanced budget to end this madness,

and to stop "kicking the can" when it comes to decisions.

I like to study economics because it drives pretty much everything and because I make retirement money on through trading. When it came to Trump or Clinton they both were horrible candidates and I'm glad that we will no longer have the constant news about Clinton's baggage. But I also believe Trump will be worse for the country and stability in the world due to what he's shared about his financial plans. There is also opportunity in this.

This is a bit long because I had to work it out in my own head. If you want the bottom line, skip to the last paragraph, because my thoughts aren't as sexy as talking about whether or not to build a wall, who deleted what emails illegally (they BOTH did), ignores Benghazi on her part and Trump being part of New York organized crime (http://www.politico.com/magazine/story/2016/05/donald-trump-2016-mob-organized-crime-213910). Dang - It sure would have been better if they were both locked up.

BACKGROUND:

The US is already in hock for what we've spent since the Reagan era and then it got far worse when we started with the Middle East conflicts. A more important measurement is the ratio of debt to income, just like what you would need to show the bank if you wanted to take out a car loan or mortgage.

A better detailed post-Depression breakdown is at this link, where you can compare what Republicans and Democrats have done:

http://thumbnails-visually.netdna-ssl.com/united-states-debt-as-a-percentage-of-gdp-19402012_50290c7b3f0c4_w1500.jpg

So yes, we are in worse shape than leading into the Great Depression or Great Recession, but we are getting by.

???

Bringing it back to the two candidates, Clinton was billed as a "tax and spend Democrat." But while she DID want to increase spending (boo-hiss) at least her team identified how to increase taxes to pay for it. The economic plan Trump has been pushing for calls for even bigger increases in spending than she did, but with decreased taxes. The first chart showed that "trickle down" didn't work during Reagan, and it works even worse in a world where I can go online to move my money to a better return anywhere that I find. (You can find more charts showing that.) If you as an individual get a pay cut, the FIRST thing you know to do is to cut spending, but it's not what is happening at the national level.

After 10 years, her plan would have cut the debt by roughly a trillion dollars and Trumps would increase it by more than 10 trillion. Easy numbers to remember. This compares what each was proposing:

(Source: http://crfb.org/blogs/what-we-know-about-president-elect-trumps-agenda)

Our two biggest national payments are Social Security and Medicare. After CRFB made the chart above, Clinton provided enough details regarding how she planned to shore up Social Security and it did have a tax increase, but at least it began right away (benefit of compounding interest) and she identified where she proposed taxing the wealthiest to get it. Trump STILL has not said what he wants to do about the shortfall in SS and since it will be later, it can't help but to hurt more. So borrowing was my first point and these payments are a related second part of debt.

Third, because of borrowing for his real estate (outside of the $650 million he owes the Chinese!!!), the Donald is closer to the New York bankers than Hillary was and his proposal to kill the Dodd-Frank Banking Act for them is going to remove the few protections created after the 2007 banking implosion which led to the crash. (https://en.wikipedia.org/wiki/Great_Recession) Did we learn nothing from that?

::010::

I'm a total rank amateur in putting this together, but it felt good when 400 leading economists in the world posted their letter and a lot of the same thoughts to reject the Trump plan. http://www.businessinsider.com/economists-denounce-trump-in-open-letter-2016-11 Interestingly, 350 economists had already denounced Clinton's proposals, but they did not endorse Trump's either, because his plan is not centered on restraint in spending and freedom to trade.

Using the above to go forward, my reading and own projection is that the borrowing and removal of protections ought to combine so that the next couple of years will be really prosperous while the Government is spending those loans and increasing OUR collective debt. That's money to be made! On the personal level, it's going to be REAL tempting to buy a vacation house and new cars and you KNOW how I like my toys.

But we all know that sooner or later every debt comes due and somebody has to pay up. Downturns are just part of life, but go back to the first chart and you can see that this ought to be much deeper and years longer than what we got in 2007-2009. It's basic economics 101, which us older folks have seen before in the US (1970s) and it is currently hitting countries like Venezuela hard. Storing up for lean times is repetitive history which we've all read about in the Bible (or Torah or Koran) and the good news is the next couple of years to store up.

The down side is that it is inevitable that adding debt to the charts above means that the dollar will sooner or later devalue badly as inflation REALLY takes off. Our first house had a 13.5% interest rate, which would more than double a current mortgage. What will that do to your budget if you have a variable loan? And it means that NOBODY is going to be able to buy your house, so have something you like long term and can afford. Us old folks will be retired and fixed retirement incomes will buy less and less, if locked into low rates. The debt still probably would have caught up to us if Clinton had been elected, but Trump's plan can not come out better.

BOTTOM LINE:

So my personal plan and suggestion is to make hay while the sun shines. Make as much as possible for the next couple of years and save up while we can, have no payments, and cut the mortgage as much and fast as possible. After the "high" of spending, in the latter portion of Trump's Presidency this should see inflation which will absolutely stop house construction, vehicle sales, vacationing, and other industries which so many of our jobs are dependent upon. If/when rates go up (not right now), gold and other things which rise with inflation will blow away a retirement annuity with a low rate. If my forecast and those of the economists are all wrong, we will still be in better shape financially and in a less stressful place emotionally. I'm sharing these thoughts is so that you might think about your own situation in light of a few more facts and not go on a borrowing spree.

Closing for the forum - The reason I've not said who I voted for is because it's in the past. We the public had a choice between really bad, worse, and a couple of candidates with no chance. At this point, please be thoughtful financially and no matter what party or candidate you supported, we need to collectively push our Congressmen as hard as possible for:

term limits so they represent the current views of their constituents,

a balanced budget to end this madness,

and to stop "kicking the can" when it comes to decisions.